The cannabis industry is on the verge of a financial revolution, with market leaders paving the way for exponential growth. But how do you identify the standout players in a field buzzing with potential? Enter 5StarsStocks Cannabis—your definitive guide to navigating the highs and lows of cannabis investing.

In this article, we’ll uncover the most promising cannabis stocks, share expert insights, and equip you with strategies to make informed investment decisions. Whether you’re a seasoned investor or just exploring this green frontier, this resource will help you uncover the opportunities that truly shine.

Get ready to discover the 5StarsStocks that could redefine your portfolio. Let’s dive into the future of cannabis investing.

What Are 5StarsStocks Cannabis Companies?

Cannabis companies, often referred to as 5StarsStocks cannabis, are the cream of the crop in the marijuana market. These companies excel in:

- Financial performance

- Market dominance

- Innovative strategies

Key Types of Cannabis Companies:

- Cultivators: These companies grow cannabis plants for recreational and medicinal use.

- Biotech Firms: Focus on cannabis-based pharmaceuticals.

- Ancillary Service Providers: Offer tools, packaging, or software for the industry.

Top 5StarsStocks Cannabis Companies to Watch

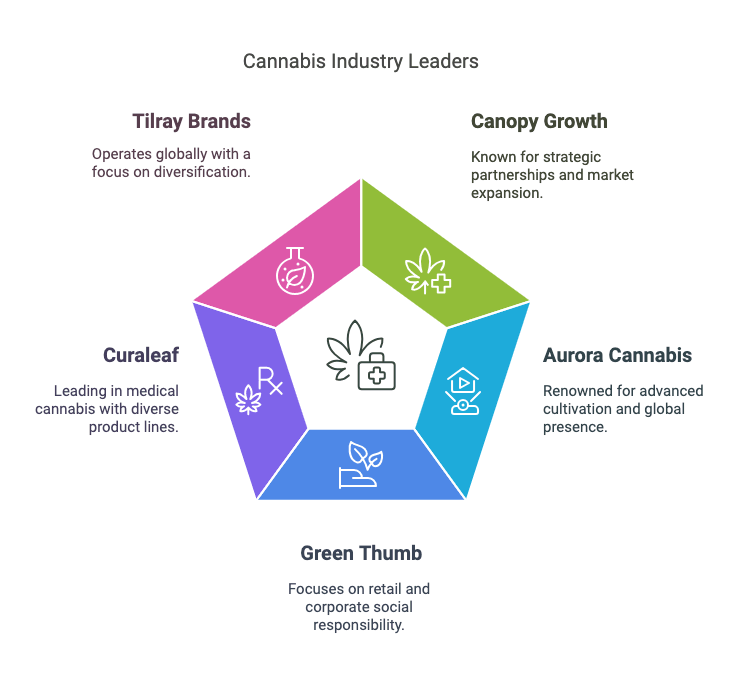

When it comes to 5starsstocks cannabis investing, knowing the leaders in the market is crucial. Here are five stocks that consistently deliver strong performance:

1. Canopy Growth Corporation (CGC)

Founded in Canada, Canopy Growth Corporation has established itself as a global leader in the cannabis industry. With a diverse brand portfolio that includes names like Tweed and Tokyo Smoke, Canopy Growth is known for its strategic partnerships and investments in innovation. Their collaboration with Constellation Brands further enhances their ability to scale and access new markets. Recent financial results show consistent growth, fueled by their expansion into the U.S. market and focus on premium cannabis products.

2. Aurora Cannabis Inc. (ACB)

Aurora Cannabis is renowned for its advanced cultivation techniques, which allow for high-quality production at scale. Based in Canada, Aurora has a strong presence in both the medical and recreational cannabis sectors. Their acquisition strategy has enabled them to build a robust global network, with operations in Europe, South America, and Australia. Aurora’s focus on innovation, including the development of unique strains and value-added products, positions it as a top contender in the industry.

3. Green Thumb Industries (GTBIF)

Green Thumb Industries is a major player in the U.S. cannabis market, with a vast network of retail locations under brands like Rise and Essence. Their focus on retail and consumer experience sets them apart, providing a seamless journey for cannabis buyers. Green Thumb also emphasizes corporate social responsibility, investing in community development and sustainable practices. Their financial performance has been bolstered by consistent store expansions and strong same-store sales growth.

4. Curaleaf Holdings (CURLF)

Curaleaf is a leading name in medical cannabis and wellness products. With a strong foothold in the U.S. market, Curaleaf continues to grow through strategic acquisitions and partnerships. Their innovative product lines, including edibles, tinctures, and topical solutions, cater to a diverse customer base. Curaleaf’s commitment to research and development ensures that they remain at the forefront of product innovation in the cannabis industry.

5. Tilray Brands Inc. (TLRY)

Tilray stands out as a global cannabis powerhouse, with operations spanning North America, Europe, and beyond. Their ability to tap into international markets gives them a competitive edge. Tilray has also diversified its offerings to include wellness products and hemp-based consumer goods, appealing to a broader audience. Recent developments, such as the acquisition of key European licenses, highlight their focus on becoming a dominant player in both medical and recreational cannabis sectors.

How to Invest in 5StarsStocks Cannabis Companies

Investing in cannabis stocks requires careful planning and research. Here are actionable steps to get started:

- Understand the Market: Research the regulatory landscape. Analyze trends like legalization and consumer demand.

- Evaluate Companies: Look at revenue growth, profit margins, and market positioning. Assess management teams and their strategies.

- Diversify Your Portfolio: Invest in a mix of large-cap and small-cap stocks. Consider ETFs for broader exposure.

- Stay Updated: Follow industry news to anticipate market shifts. Use tools like financial platforms to track stock performance.

Key Considerations and Risks in Cannabis Investing

While the cannabis market offers lucrative opportunities, it’s not without risks. Here are some challenges investors face:

- Regulatory Uncertainty: Legal changes can impact stock performance.

- Market Volatility: Cannabis stocks are known for their high fluctuations.

- Operational Challenges: Supply chain issues and scalability can affect profitability.

Tips to Mitigate Risks:

- Conduct thorough due diligence.

- Invest only what you can afford to lose.

- Regularly review and adjust your investment strategy.

Why Choose 5StarsStocks Cannabis for Your Portfolio?

The “5StarsStocks cannabis” segment offers unique benefits:

- High Growth Potential: The cannabis industry is expected to grow significantly over the next decade.

- Diverse Investment Options: From cultivation to ancillary services, the industry offers various entry points.

- Social and Medical Relevance: Cannabis legalization and its medical applications make it a forward-thinking investment.

Resources for Staying Ahead in Cannabis Investing

To excel in cannabis investing, staying informed is key. Here are some resources to consider:

- News Websites: MarketWatch, CNBC, and specialized cannabis outlets.

- Financial Tools: Yahoo Finance, Barchart, and Bloomberg.

- Social Media: Follow industry influencers and company updates.

- Books and Webinars: Invest in educational resources for in-depth knowledge.

FAQs

What are 5StarsStocks cannabis companies?

These are top-performing cannabis companies known for their strong financial performance and market dominance.

How can I start investing in cannabis stocks?

Research the market, evaluate companies, diversify your portfolio, and use tools to track performance.

What are the risks of investing in cannabis?

Regulatory uncertainty, market volatility, and operational challenges are key risks to consider.

By following this guide, you’re well on your way to becoming a successful cannabis investor.

Conclusion

Investing in 5StarsStocks cannabis companies can be a lucrative endeavor if approached strategically. By understanding the market, evaluating top companies, and staying informed, you can make well-informed decisions and maximize your returns. Dive into the world of cannabis 5starsstocks .com investing and take your portfolio to new heights!