The world of finance, with its promise of wealth and success, can be a risky business. Fortunes can be made and lost in the blink of an eye, and the temptation to take shortcuts can be overwhelming. This blog post examines a case that serves as a stark reminder of the pitfalls of chasing fast money through illegal means: the story of Spartan Capital Securities LLC Broker Jordan Meadow, a promising financial professional brought down by allegations of insider trading.

From Rising Star to SEC Target: The Story of Spartan Capital Securities LLC Broker Jordan Meadow

Spartan Capital Securities LLC Broker Jordan Meadow began his career with a strong background in economics and finance. He gained experience at established financial institutions and eventually joined Spartan Capital Securities, a firm known for its diverse range of financial services, including wealth management, investment banking, and institutional services. Meadow quickly climbed the ladder at Spartan Capital, assuming a leadership role in the Special Situations Group (SSG). This group catered to high-net-worth individuals and institutions, focusing on “special situation” investments, which aim to capitalise on unique opportunities outside the traditional market.

Meadow’s future seemed bright. However, in June 2023, his career took a sharp turn. The U.S. Securities and Exchange Commission (SEC) filed a complaint against him, alleging that he had engaged in insider trading. The SEC accused Meadow of accessing confidential information about potential mergers and acquisitions from his girlfriend’s laptop. His girlfriend worked at a prominent New York investment bank, giving him access to non-public information which he then used to make profitable trades.

Examining the Allegations Against Spartan Capital Securities LLC Broker Jordan Meadow

The SEC’s complaint detailed Meadow’s alleged actions. They claimed that Meadow not only traded on this insider information for personal gain, making over $730,000 in profit, but also tipped off his clients, enabling them to make millions in illicit gains. In return, Meadow allegedly received hundreds of thousands of dollars in commissions.

The SEC is seeking a permanent injunction against Meadow, the return of his illegal profits plus interest, and civil penalties. The complaint also requests that he be banned from serving as an officer or director of any public company.

Spartan Capital Securities: Responsibility and Response

The allegations against Meadow have raised concerns about Spartan Capital Securities’ role in overseeing their employees. Were there warning signs that the firm overlooked? Did they have adequate compliance measures to prevent insider trading? These questions will likely be heavily scrutinised as the case progresses.

Important Note: The provided sources do not contain specific information regarding Spartan Capital’s internal investigation, response to the allegations, or communication with clients impacted by Meadow’s actions. This information would require further research from publicly available sources or legal filings.

Insider Trading: A Threat to Financial Market Integrity

Spartan Capital Securities LLC Broker Jordan Meadow’s case exposes a recurring issue in finance: insider trading. This crime undermines the fairness and integrity of markets, damaging investor confidence and potentially harming many individuals.

The SEC, responsible for enforcing federal securities laws, actively investigates and prosecutes insider trading cases. Penalties for those found guilty can be severe, including substantial fines, imprisonment, and bans from the securities industry.

Protecting Yourself: Lessons for Investors from the Spartan Capital Securities LLC Broker Jordan Meadow Case

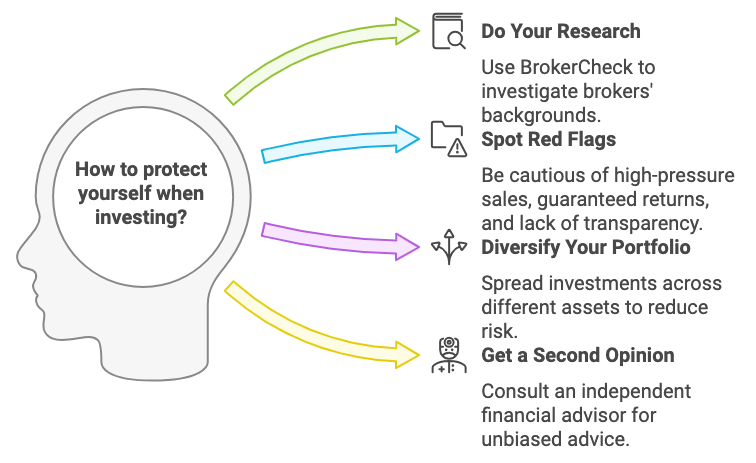

Spartan Capital Securities LLC Broker Jordan Meadow’s case serves as a reminder that investors must be proactive in protecting their financial well-being. Here are some key takeaways:

Do Your Research

Before entrusting anyone with your money, thoroughly research their background and credentials. The Financial Industry Regulatory Authority (FINRA) offers a valuable resource called BrokerCheck that lets investors investigate the history of brokers and investment advisors, including any complaints or disciplinary actions.

Spotting Red Flags: Be wary of advisors who:

- Pressure you to invest in obscure or high-risk ventures

- Promise guaranteed returns

- Hesitate to provide detailed information about investments

- Frequently change your investments to generate commissions

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversification can help to reduce losses if one investment performs poorly.

Get a Second Opinion

Don’t hesitate to consult an independent financial advisor to get an unbiased assessment of your investment strategy.

Conclusion: The Importance of Investor Vigilance

The story of Spartan Capital Securities LLC Broker Jordan Meadow is a cautionary tale, reminding us that the pursuit of quick riches through unethical methods can have devastating consequences. As investors, we must be proactive in protecting ourselves from fraud. By staying informed, conducting thorough due diligence, and recognising red flags, we can help safeguard our financial future. Remember, knowledge is power, and in finance, it can be the key to making informed decisions that protect and grow your wealth.

Disclaimer: This blog post is intended for informational purposes only. It does not reflect our opinions or analysis.