A vital financial tool that allows people and companies to reduce possible economic losses is insurance. Crucial in the insurance business is knowledge of fundamental terms such as risks, hazards, and perils since these words describe the type of dangers to insured properties and lives. Even if they are normally used interchangeably, these words have different and clear meanings in insurance coverage documents and effects. This article discusses the distinctions among risks, perils, and hazards highlighting their relevance for underwriting and claims evaluation.

Risk in insurance: Overview

In insurance, risk is the uncertainty about one’s financial losses. This involves the probability of an insurable incident happening and causing a claim. Since insurers evaluate, control, and price risks before providing coverage, risk acts as the basis of insurance policies. To better safeguard your company and place from risks, utilize the comparison tool of https://www.quoteradar.co.uk/ to compare various policies and then select the right one for you.

Types of Risks:

- Pure risk: Pure risk is a kind of risk that refers to events that can only bring about loss or no difference. There is no possibility of advantage. Some possibilities are death, sickness, and property damage. Pure risks are usually under insurance.

- Speculative risk: A speculative risk brings with it the odds of gain, loss, or no change. Starting a company, gambling, and investing are all examples of it. Insurers mostly don’t protect speculative risks.

Hazards: Overview

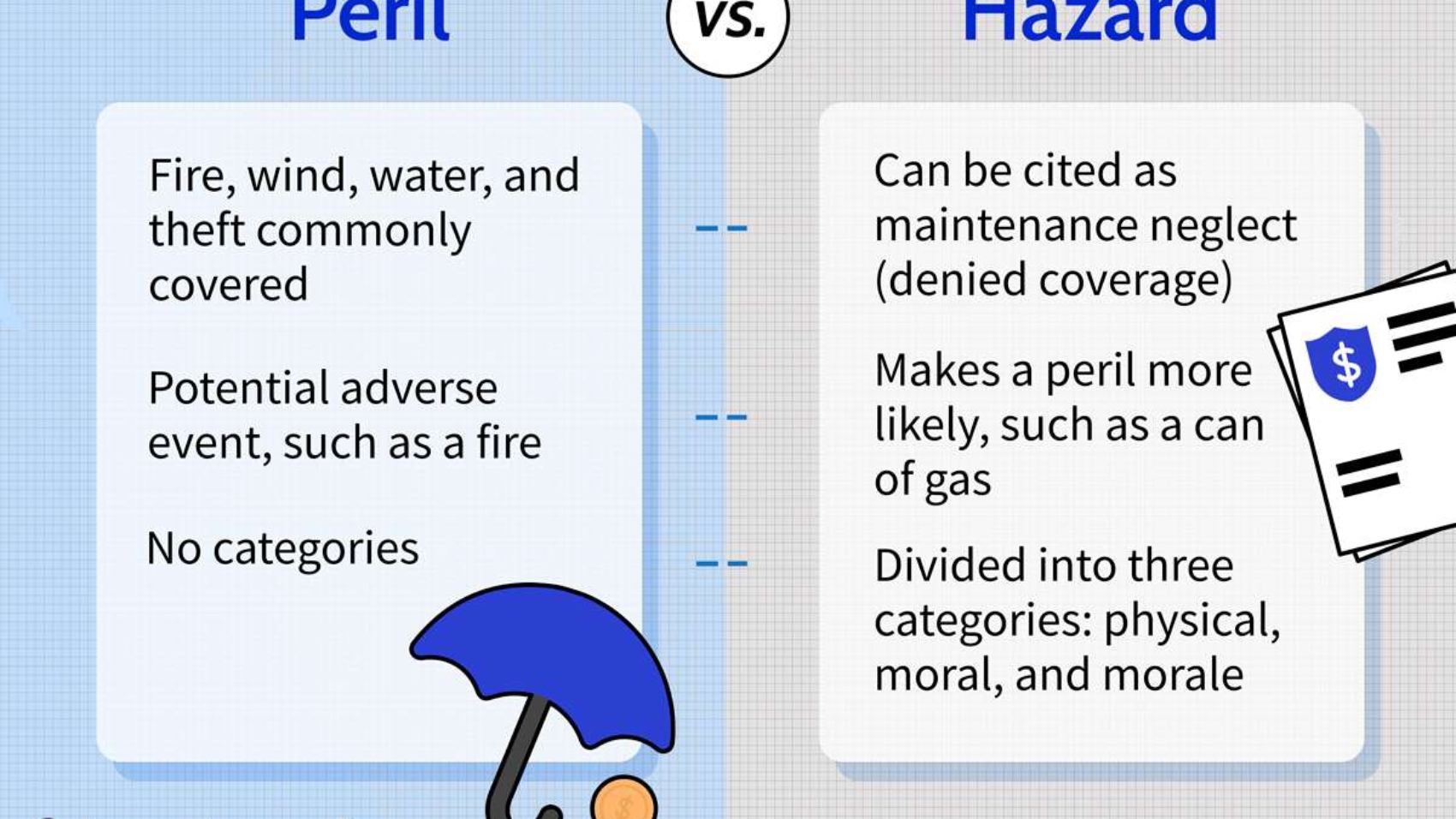

A hazard is something that raises the likelihood of a loss or causes the loss directly. For instance, a swimming pool might be seen as a hazard if it raises the chances of someone being hurt on your property.

Insurance providers will ask many questions about your home before they agree to cover it because the presence of particular hazards raises the odds of a claim. Your rate will probably go up—or your carrier may choose to cancel your policy—when your home is examined and number of hazards are discovered by the inspector.

Most Usual Kinds Of Insurance Risks:

Although hazards are generally divided into three main categories—physical hazards, moral hazards, and morale hazards—insurance inspectors are mainly looking for the former when they evaluate your house. Keeping this in mind, here are some typical physical hazards you should possible observe in order to get cheap insurance:

- A swimming pool or hot tub could increase the chances of bodily damage or even death.

- Damaged or clogged gutters, which could rise the chances of water damage following a storm.

- Fuse boxes or damaged electrical wiring which might cause a fire likelihood.

- Heavy tree branches above the house, which might raise chances of roof damage.

- Significant splits in sidewalk or driveway, which would rise the chances of trips or falls.

Perils: Overview

Concerning insurance, a peril means the particular risks or events that could result in damage to possessions, bodily harm, or other types of loss. Poison, robbery, and natural catastrophes including floods or earthquakes, for example, are typical perils in many insurance policies.

For instance, your house sustains major destruction from a storm one day. The storm is seen as a peril. Your insurance provider will assist in covering the cost of the repairs up to your policy limit if your coverage includes storm damage. Designed to guard against many hazards, insurance policies are absolutely vital to provide the proper protection for your company.

Main Elements Of Peril:

Understanding perils in insurance involves having knowledge of three main parts:

- Covered Perils:

Covered perils are the particular risks an insurance policy will cover. When you buy an insurance policy, the document will show you the risks covered. For instance, a standard commercial insurance package would usually include perils like vandalism, theft, and fire.

- Excluded Perils:

Perils which an insurance does not cover are known as excluded ones. The policy document makes these exclusions obvious. Many common insurance policies, for instance, exclude coverage for floods or earthquakes. What this implies is that if a flood damages your company, the insurance will not pay for the repairs unless you have flood insurance of their own.People and companies can guarantee better coverage against unexpected losses and make knowledgeable judgments regarding their insurance requirements by adeptly handling risks and dangers.