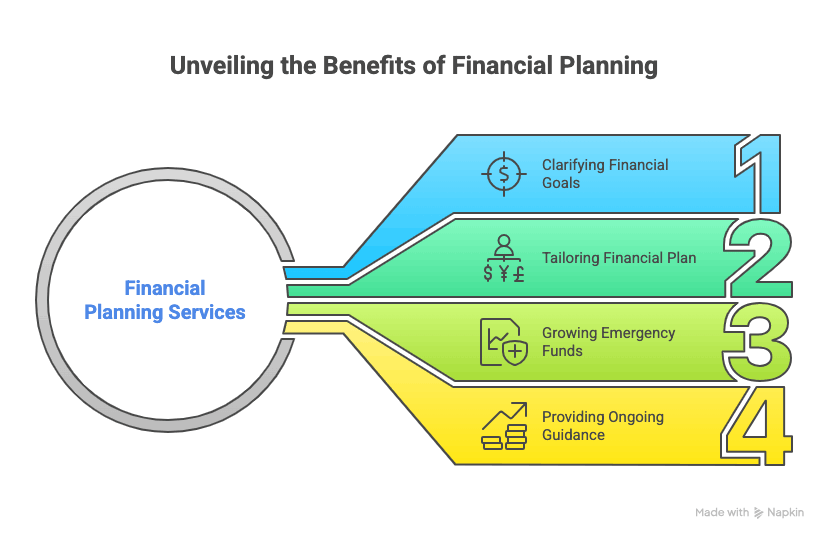

A knowledgeable financial planner can help you reach your goals, such as covering college expenses or financing a major purchase. Professional financial planning services give you access to an expert who understands different strategies of personal finance. You’ll get help with budgeting, cash flow analysis, savings, emergency funds, and benefits analysis. Here are some ways a financial planner may help you set and achieve goals:

Clarifying Your Financial Goals

Working with a financial planner allows you to clarify your financial goals. You may have a specific goal like saving for a home, starting a business, or retiring comfortably. Such goals require a plan. Professional financial planning services allow you to break down your ambition into clear, measurable, time-bound targets. They also align your goals with your income and expenses.

Instead of just saving for a home, a financial planner will help you set a specific amount, timeline, and monthly saving target. Skilled planners can help you set priorities based on your life stage, income, and risk tolerance. Prioritizing allows you to focus on what matters most and avoid competing goals that may become overwhelming.

Tailoring Your Financial Plan

Achieving goals requires a personalized plan and investment strategy. Once you have clear goals, a financial planner develops a plan that aligns with your situation. The plan factors in your income, expenses, assets, liabilities, and future commitments to suit your lifestyle and financial capacity.

Whether you need to diversify your investment portfolio or make a large purchase, planners help with strategy development. They align your investment strategy with your timeline and risk tolerance, and explain the options that best support your financial goals. Planners offer services like benefits analysis and adjust your strategy over time to adapt to your changing needs. Continuous reviews and adjustments keep you on track despite fluctuating markets and personal situations.

Growing Your Emergency Funds

Savings and emergency funds help you prepare for uncertainties. You may experience a medical emergency, lose a job, or face the effects of economic downturns. It’s helpful to have a safety net to protect your finances from taking a hit. A financial planner advises you to prepare for uncertainties through savings and emergency funds.

They develop contingency plans that give you financial stability by protecting your investments and savings from potential setbacks. Financial planners also help you plan for long-term uncertainties like retirement. They offer insight into your retirement budget and maintenance requirements and provide strategies for saving for such goals.

Providing Ongoing Financial Guidance

Achieving goals requires commitment and the ability to adapt to changes. Creating a plan is only the first step, as changing circumstances may require you to adjust your strategy over time. Working with a financial planner allows you to assess changes and make the right decision during each phase. Planners track your assets, savings, and investments and regularly check your progress toward your goals.

Although they adapt the plan to emerging changes, planners remain focused on your goals. They’re updated on trends, tax regulations, and new investment opportunities. You can also consult them for major decisions like marriage or having a child, allowing you to make proactive decisions.

Get Professional Financial Planning Services

Financial planners give you professional advice to help you make the right decisions with your income. Whether you want to save for something or invest, financial planners have knowledge in these areas. Speak to a wealth enhancement company today to find out more about financial planning services.