Money can feel confusing. Saving is one step. But knowing how savings grow over time is another. This is where the Dave Ramsey investment calculator comes in. It is a simple online tool that shows how your money can build with time, interest, and smart investing.

If you ever wondered, “How much will I have if I invest this amount each month?” this calculator gives you the answer. Let’s break it down in easy words.

What Is the Dave Ramsey Investment Calculator?

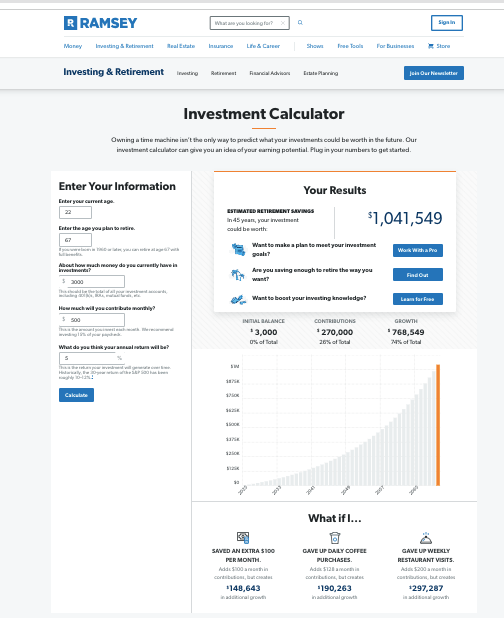

The Dave Ramsey investment calculator is a free tool on his website. You enter numbers like:

- How much money you already saved

- How much you will invest each month

- The number of years you will keep investing

- The average return rate (usually around 10% for stock market growth)

Then the calculator shows:

- Your total contributions

- The total growth of your money

- The ending balance

This way, you see how small steps turn into big results — a core part of financial life planning.

Why Does Dave Ramsey Promote It?

Dave Ramsey believes in long-term investing. He often says the key to wealth is steady investing, not quick wins. The calculator shows this idea in action. For example:

- If you invest $500 a month for 20 years at 10% growth, you could end with over $380,000.

- If you wait and invest for 30 years, that number grows to $1,000,000+.

The tool is a simple way to “see” compound growth — one of the main lessons in the foundations of personal finance. It helps people trust the process.

How to Use the Calculator Step by Step

Here’s how you can use it:

- Open the calculator on Dave Ramsey’s official site.

- Enter your starting balance (this could be $0 if you’re just beginning).

- Add monthly contributions – the amount you plan to put in each month.

- Choose the time frame – maybe 10, 20, or 30 years.

- Add the rate of return – Dave often uses 10% as the average stock market return.

- Click “calculate.”

The result shows your future total wealth, including growth. You can use this to plan retirement goals or long-term savings targets.

Why Compound Growth Matters

The calculator works because of compound growth. This means your money earns interest, and then that interest also earns more interest. Over time, this snowball effect becomes huge.

For example:

- Year 1: $1,000 invested grows to $1,100 (10%).

- Year 2: You earn 10% not just on $1,000 but on $1,100.

- Year 3: The growth continues.

After many years, the money multiplies much faster than you expect — that’s the power of investing for financial growth.

Benefits of the Dave Ramsey Investment Calculator

Here are some key benefits:

- Simple to use – no complex math needed.

- Motivating – shows how small savings add up.

- Helps planning – you can set goals for retirement or big purchases.

- Visual growth – seeing numbers on screen feels real.

It makes money planning less scary and helps you stay on track toward strong personal finance habits.

Common Mistakes to Avoid

While the calculator is powerful, many people make mistakes:

- Expecting exact results. The stock market can go up and down.

- Not starting early. The later you start, the harder it is to catch up.

- Investing too little. Small amounts help, but bigger consistent investments bring better results.

- Forgetting inflation. Prices rise over time, so $1,000 today won’t be the same in 20 years.

Use the calculator as a guide, not a guarantee — and avoid letting debt slow your progress.

Dave Ramsey’s Investment Advice Alongside the Calculator

Dave Ramsey suggests:

- Invest 15% of your income for retirement.

- Focus on mutual funds with long-term growth.

- Avoid debt before heavy investing.

- Stay invested even when the market is shaky.

These ideas line up with smart investing principles that reward patience and consistency.

Who Should Use It?

Anyone can use it:

- Young workers starting their first job.

- Parents saving for college funds.

- Families planning retirement.

- Anyone curious about how their money could grow.

It’s not just for finance experts. It’s for everyday people who want financial peace of mind.

FAQs

Is the Dave Ramsey investment calculator free?

Yes, it’s completely free to use on his website.

Can it predict exact returns?

No, it only gives estimates. Real returns can be higher or lower.

Do I need an account to use it?

No, you can use it without signing up.

What rate of return should I enter?

Dave suggests 10% as the long-term stock market average, but you can use any number.

Is this the same as a retirement calculator?

Yes, it’s very similar. It helps plan for retirement or other goals.

Conclusion

The Dave Ramsey investment calculator is a simple but powerful tool. It shows how money grows when you invest with time and patience. While it cannot predict the future, it gives you a clear idea of how savings can turn into wealth.

If you want to take control of your money, try the investment calculator today. Enter your numbers, see the results, and start planning for a stronger financial future. You can also explore more on how to invest for long-term growth or build a solid personal finance plan.