As a small business owner, you deal with risks each day. Things like a customer getting hurt or damaging someone’s stuff can happen. The cheapest general liability insurance for small business helps protect you from these problems. It does not cost a lot. This insurance covers claims from others about hurt bodies, broken things, or ad mistakes. It can start at $11 to $21 a month for simple jobs like advice work or taking photos. In this guide, we show options for new owners, start-ups, one-person shops, and free workers who need affordable general liability insurance on a small budget.

What Is General Liability Insurance?

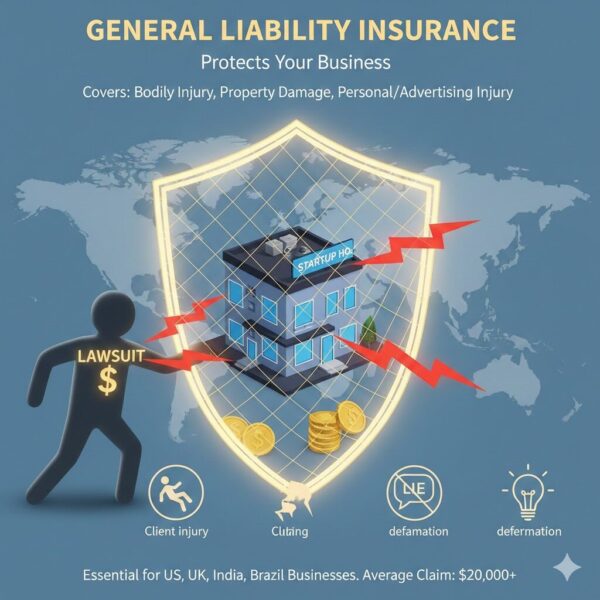

This insurance is like a safety net for your business. It pays if someone sues you for causing harm or damage while you work. For example, if a client falls in your home office and gets hurt, it covers doctor bills and court costs. It also helps with claims about bad words, lies, or stealing ideas in your ads.

Small businesses in top countries like the US and UK, or growing ones like India and Brazil, often need this to sign deals or rent space. Without it, one claim can take all your money. Facts show the usual claim for body hurt is about $20,000. Product claims can be millions. That is why low cost general liability insurance is key for new businesses.

Main things it covers:

- Third-party bodily injury coverage: Pays for hurts to others, like a customer tripping on your tools.

- Property damage liability: Fixes damage to other people’s things, like breaking a client’s cup.

- Personal and advertising injury: Deals with suits over bad talk or idea theft.

- Medical payments: Fast money for small hurts without saying it’s your fault.

It does not cover some things, like on-purpose bad acts or work mistakes. Those need other insurance. Always look at your insurance policy exclusions to avoid missing spots.

Why Pick the Cheapest General Liability Insurance for Small Business?

New businesses and free workers often have little money. Good news: You can get cheap small business liability insurance that still keeps you safe. Usual costs are $42 to $85 a month for small shops with less than $250,000 in sales and few workers. For one-person or home jobs, it can be under $30 a month.

People in service jobs, like advice or drawing, pay less because risks are low. Builders or food sellers pay more due to hands-on work. Where you live matters too. Places like Maryland cost about $35 a month. California might be $84 for the same.

Real stories from owners show it helps. One free worker said on sites that changing companies cut their bill from $155 to $60 a month. This lets them put more money back into their work. It makes budget general liability insurance great for tiny businesses with tight money.

What Makes General Liability Insurance Rates Change?

Many things set your general liability insurance rates. Know them to find low premium business insurance.

- Job Type and Risks: Low-risk jobs like selling homes or taking photos cost $32 to $54 a month. High-risk like yard work is $61 to $368.

- Business Size and Money Made: New ones with no workers pay less than those with teams. Pick plans that fit your size.

- Where You Are: Costs change by place due to laws and past claims. In the US, Iowa is about $38 a month.

- Coverage Amounts and Pay-Outs: Normal is $1 million per event and $2 million total. More liability coverage limits raise price, but higher insurance deductible lowers it.

- Past Claims: No claims keep costs down. Use safety steps to stop them.

- Plan Type: Just this insurance is cheaper than mixed ones, but mixing can save up to 20%.

Costs have gone up a bit in 2026 from more suits, but smart picks keep it low.

Best Companies for the Cheapest General Liability Insurance for Small Business

From checks, here are top choices for inexpensive liability insurance for business. We picked ones with good scores, fast quotes, and easy fits for new ones, free workers, and solo jobs.

- Thimble: Great for new businesses and free workers who need short plans. Costs start at $17 a month for general liability insurance for small businesses. It has hour, day, or month choices, good for gig jobs like photos or events. Plus points: Fast online insurance quotes and free proof papers (COI). One person said it’s “way less than year plans elsewhere.” Minus: Not always open for calls. Best for cheapest general liability insurance for freelancers or home jobs.

- Simply Business: Best for checking prices, starts at $20.75 a month. Works with companies like Travelers for custom plans. Usual for low-risk: $21.25 a month. Good for one-person in pro services. Has same-day cover and extras like pro liability. People on sites like it for quick, cheap changes.

- Next Insurance: Starts at $19 a month, with most under $75. Has levels (Basic, Premier, Deluxe) for builders and service jobs. Covers tools and fast COIs by app. Great for cheapest general liability insurance for independent contractors. Plus: Quick claims (2 days) and grows with you. Open all over US.

- biBERK: Under $30 a month when mixed, from big company Berkshire Hathaway. Saves 20% on bundled business insurance like mix with property. Fits LLCs and small groups in over 50 jobs. Online claims and COIs are easy. Minus: Only in 27 states.

- The Hartford: Usual $68 a month but strong help. Over 200 years old, with extras like web safety. Best for always-open help. Quotes for note-takers start low, about $418 a year.

- Hiscox: Liked on sites for free workers, $50 to $60 a month. Made for low-risk advice. Fast online buy and good reviews.

- Insureon: Gets quotes from $21 a month with partners like Chubb. Usual for buyers: $42 a month. Fast form (under a day for COI). Good for checking general liability insurance quotes in many jobs.

These are top for cheapest general liability insurance for startups, sole proprietors, and service businesses. For example, a washer job might pay $315 a month with Next basic, while a photo taker pays $32.

How to Get the Cheapest General Liability Insurance Online

Do these steps for general liability insurance under $30 per month:

- Check What You Need: Find your risks and cover amounts. Free workers may need $1 million; builders more.

- Get Many Quotes: Use sites like Insureon or Simply Business for quick checks1. Apps make it fast.

- Mix Plans: Join with property or pro liability for deals. A mix often costs less.

- Pick Easy Pays: Choose monthly general liability insurance cost to help money flow. Some have cheapest general liability insurance with monthly payments.

- Handle Risks: Teach workers, use sign-offs, and keep safe to cut costs over time2.

- Buy Direct: Skip middle people to save fees. Look for cheapest general liability insurance with instant quote.

- Check Each Year: Prices change; look again to stay cheap.

Owners say they save a lot by mixing or changing.

How Professional Liability Differs from General

Do not mix them. General covers body hurts and thing damage. Professional (error insurance) covers bad advice, like a helper’s wrong tip. Many mix them for full business risk protection. Free workers often need both for all claims coverage.

Wrong Ideas About Small Business Insurance

Wrong: Too much for new ones. True: With low cost general liability insurance, start small and grow.

Wrong: No need at home. True: Home plans skip business risks; get special cover.

Wrong: All plans same. True: Check insurance carriers for small businesses for best.

FAQs on Cheapest General Liability Insurance for Small Business

What is the usual small business liability insurance cost?

It is about $42 to $85 a month for most small shops.This depends on your job type, size, and where you live.

Can I get general liability insurance under $25 a month?

Yes, for low-risk jobs like one-person advice work.Providers like Thimble or Simply Business offer these low rates.

Is there cheapest general liability insurance for small contractors out there?

Yes, options exist for builders and hands-on jobs.Next Insurance starts levels at just $19 a month for basics.

How to get a certificate of insurance (COI)?

Most companies give it right away after you buy online.You can download it from their app or site in minutes.

Conclusion

In the end, getting the cheapest general liability insurance for small business lets owners grow without worry. Companies like Thimble, Next, and Simply Business give bendy, low plans from under $25 a month. They cover key things like body hurts and thing damage. By checking quotes, mixing, and handling risks, you get affordable general liability insurance that fits your money3. Ready to get a quote and keep your business safe? What hard parts have you had finding good cover?

References:

- Small Business Insurance – Thimble – Ideal for freelancers and contractors needing flexible, monthly coverage options. ↩︎

- 6 Cheapest General Liability Insurance Companies for Small Businesses ↩︎

- Cheap General Liability Insurance – Starting at $21/Month | Insureon – Great for small business owners looking for quick quotes and low starting rates. ↩︎