The Dow Jones u.s. completion total stock market index helps investors get full U.S. market coverage. It tracks all U.S. stocks but skips those in the S&P 500. So, it covers mid-size, small, and tiny companies. Many folks own S&P 500 funds for big companies. Add the dow jones u.s. completion total stock market index to get the rest of the market. It’s easy!

This index builds a total U.S. stock market benchmark. It works as an extended market index for non-S&P 500 stocks. Use it to spread money across many companies. It gives growth from small firms. For more on entry-level roles in investment banking, see how this fits plans.

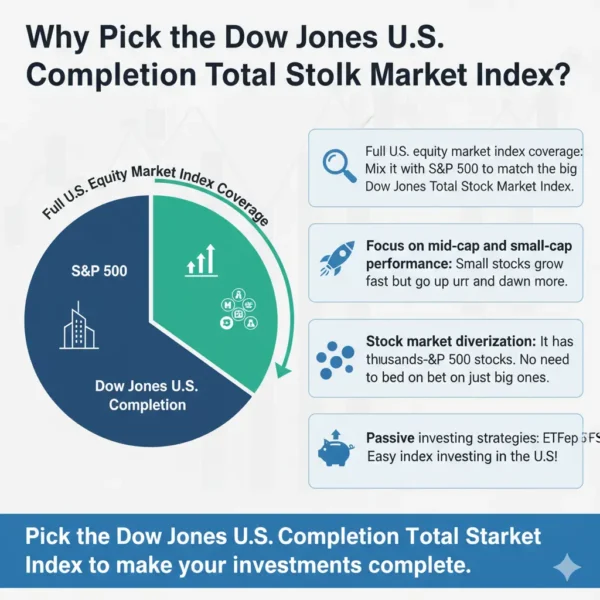

Why Pick the Dow Jones U.S. Completion Total Stock Market Index?

Pick the dow jones u.s. completion total stock market index to make your investments complete. Here are simple reasons:

- Full U.S. equity market index coverage: Mix it with S&P 500 to match the big Dow Jones Total Stock Market Index.

- Focus on mid-cap and small-cap performance: Small stocks grow fast but go up and down more.

- Stock market diversification: It has thousands of non-S&P 500 stocks. No need to bet on just big ones.

- Passive investing strategies: Cheap ETFs follow it. Easy index investing in the U.S.!

It uses market capitalization weighting. Big companies count more. This matches the real market. No S&P 500 overlap. It fits with big stock funds. Learn small business growth strategies for ideas.

Who Likes This Index Best?

Many people love the Dow Jones U.S. completion total stock market index. Here’s who:

- Folks with S&P 500: You have big stocks? Add this for total U.S. market exposure.

- Growth fans: Wait long? Take risk and volatility in small caps for big wins.

- Helpers building plans: S&P 500 is main. This is extra for mid and small.

- Big users: Fund bosses check extended market index funds with it.

How the Index Works

The Dow Jones U.S. The completion total stock market index has easy rules. S&P Dow Jones runs it. Start with all U.S. stocks. Take out S&P 500. Keep the rest.

- Equity index composition: 3,500 stocks. Mostly mid, small, tiny.

- Stock index methodology: Weight by size. Stocks must be easy to buy.

- Rebalancing: Check every 3 months.

This gives wide U.S. stock market coverage. No mix-up with big indexes. See rules at S&P Dow Jones Indices1. Link to how to improve financial literacy for smart picks.

How It Pairs with S&P 500

The Dow Jones u.s. The total stock market index goes great with S&P 500. Together, full market!

| Part | S&P 500 | Dow Jones U.S. Completion Total Stock Market Index |

| What | Top 500 big | Non-S&P 500 stocks (mid, small, tiny) |

| Job | Steady | Grow fast |

| Up-Down | Less | More, but safe spread |

| Use | Main | Extra for investing beyond large-cap stocks |

This mix matches the whole U.S. economy. Covers U.S. economy and equity sectors. See investment tips.

S&P 500 vs Dow Jones Completion Index

What is the difference between S&P 500 and Dow Jones Completion Index? S&P 500 = big companies. Completion = all others. No double-up. Clean add!

Past Results and Gains

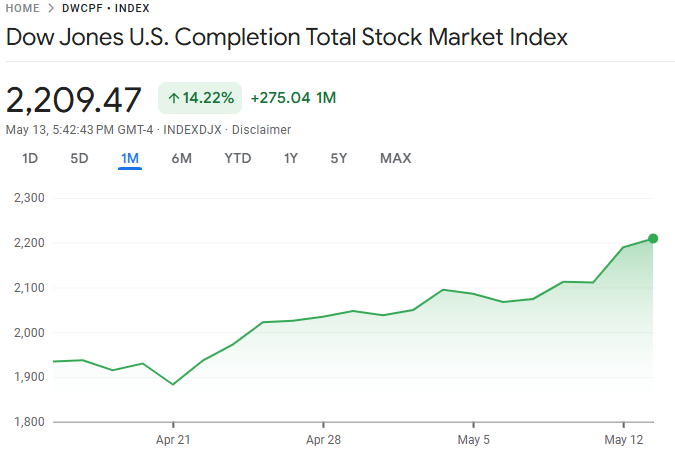

Dow Jones indexes performance changes. The Dow Jones u.s. completion total stock market index (ticker: DWCPF Index) does well over time.

- Last 10 years: Beat big stocks sometimes. Small wins big in good times.

- 2024-2025: Small stocks dip but are cheap now.

- See now at Yahoo Finance ^DWCPF2.

Dow Jones U.S. Completion Index historical performance: Small stocks shine in up markets. Slow down. Fits mid-cap and small-cap performance. Read why Nvidia stock dropped.

Gains Over Last 10 Years

2015-2025: 8-10% a year. Numbers move with market. Small stocks push wins. Compare to Russell 2000 in stock market benchmarks comparison.

How to Buy the Dow Jones U.S. Completion Total Stock Market Index

Want in? Steps for how to invest in the Dow Jones u.s. completion total stock market index:

- Pick ETF: Find U.S. completion index ETF for DWCPF Index.

- Get account: Use a cheap broker.

- Buy: Put in money you can lose.

- Check yearly: Fix mix.

Funds like S&P 500 completion index. No exact ETF, but close ones work. See how2invest.

Top ETFs for Dow Jones U.S. Completion Index

ETFs for Dow Jones extended market index match. Search U.S. completion index ETF.

Compare: Completion vs Total Market

Dow Jones Completion Index vs Total Market Index comparison: Total = all. Completion = no S&P 500. Use for how to get full U.S. market exposure using the Completion Index. Link personal finance.

Is DWCPF Good for Spread?

Yes! Is DWCPF a good investment for diversification? Spreads risk. Tracks performance tracking of U.S. equities.

Make Plans with Dow Jones U.S. Completion Total Stock Market Index

Use dow jones u.s. completion total stock market index for passive investing strategies. Fits total market index funds.

- Main + Extra: S&P main, this extra.

- ETF tracking indices: Cheap, simple.

- Benchmark index for mutual funds: Check Dow Jones U.S. equity index performance.

Helps U.S. mid-cap and small-cap index. Good for extended market investing using the Dow Jones Completion Index. See 5 foundations of personal finance.

Risks to Know

Small stocks bounce more. Risk and volatility in small caps. But win long-term. Mix with big. Read debt.

FAQs About the Dow Jones U.S. Completion Total Stock Market Index

What is the Dow Jones U.S. Completion Total Stock Market Index?

Tracks U.S. stocks not in S&P 500.

Which companies are included in the Dow Jones Completion Index?

Mid, small, tiny ones that trade easy.

How does the Dow Jones Completion Index complement the S&P 500?

Adds rest for full picture.

Dow Jones Completion Index fund performance 2025?

See at CNBC .DWCPF3.

In Conclusion

The Dow Jones u.s. completion total stock market index makes U.S. investing full and fun. It fixes S&P 500 holes. This extended market index adds spread and growth. Mix with big stocks for the U.S. equity market index. All win! See globalization effects.

What role does the dow jones u.s. completion total stock market index play in your money plan?

References

- S&P Dow Jones Indices. (2025). Dow Jones U.S. Completion Total Stock Market Index Methodology. spglobal.com/spdji. Rules and facts. ↩︎

- Yahoo Finance. (2025). ^DWCPF Quote and Chart. finance.yahoo.com. Prices and past wins. ↩︎

- CNBC. (2025). .DWCPF Market Summary. cnbc.com. Live news. ↩︎