If you’re an early-stage founder gearing up for seed funding, figuring out how to do valuation of a startup can feel overwhelming. But don’t worry—it’s a mix of art and science that gets clearer with the right approach. This guide breaks it down simply, using real-world methods and examples. We’ll cover everything from basic factors to advanced techniques, helping you estimate your company’s worth confidently. Whether you have no revenue yet or are building forecasts, you’ll learn actionable steps tailored for Tier 1 and Tier 2 countries like the US, UK, Canada, and Australia, where investor ecosystems thrive.

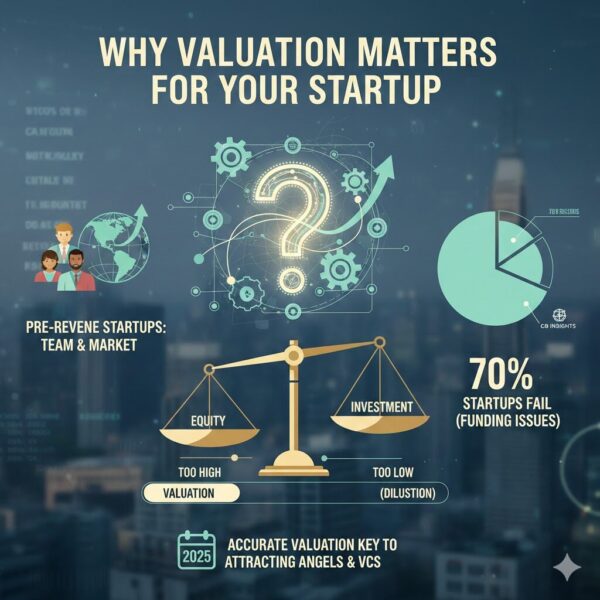

Why Valuation Matters for Your Startup

Valuation sets the stage for funding rounds. It determines how much equity you give away for investment. Get it too high, and investors might walk away. Too low, and you dilute your ownership unnecessarily. For pre-revenue startups, valuation often relies on qualitative elements like your team and market potential.

Statistics show the stakes: According to CB Insights, over 70% of startups fail due to funding issues, often tied to mismatched valuations. In 2025, with markets recovering from economic dips, accurate valuations are key to attracting angels and VCs1.

Key Factors Influencing Startup Valuation

Before diving into methods, understand what drives value. Investors look at:

- Team Expertise: Strong founders with track records can boost value by 20-30%.

- Market Opportunity: A large total addressable market (TAM) like the $5 trillion global tech sector adds appeal.

- Product Traction: Even a prototype can justify higher estimates.

- Competitive Landscape: Fewer rivals mean less risk.

- Financial Projections: Revenue forecasts, even if speculative, provide a backbone.

For entrepreneurs in Tier 1 countries, location matters—Silicon Valley startups often command 1.5x multiples compared to others due to ecosystem advantages.

How to Do Valuation of a Startup: Essential Methods

Here, we explore proven startup valuation methods. Start by choosing one or two that fit your stage, then combine for accuracy.

1. Berkus Method: Ideal for Pre-Revenue Startups

Developed by Dave Berkus, this assigns up to $500,000 per key element. Boldly assess your sound idea, prototype, quality management team, strategic relationships, and product rollout or sales.

Steps to Apply:

- Rate each factor: Add $500K for a strong team, $500K for a working prototype.

- Cap at $2 million pre-revenue or $2.5 million post.

- Example: A SaaS startup with a solid idea ($500K), prototype ($500K), and team ($500K) totals $1.5 million.

Pros: Simple and avoids shaky forecasts. Cons: Subjective. Use it if you’re bootstrapping without sales data.

2. Scorecard Valuation Method: Compare to Peers

Bill Payne’s method benchmarks your startup against similar funded ones. Adjust based on strengths.

Steps to Apply:

- Find average pre-money valuation for your sector (e.g., $3 million for early tech via Crunchbase).

- Weight factors: Team (30%), market size (25%), product (15%), competition (10%), sales channels (10%), other (10%).

- Score each (e.g., 150% for superior team) and multiply.

- Example: If peers average $2 million and your weighted score is 120%, value at $2.4 million.

This shines for early stage startup valuation, emphasizing qualitative edges.

3. Cost-to-Duplicate Approach: Grounded in Tangibles

Calculate what it would cost to rebuild your startup from scratch.

Steps to Apply:

- Sum assets: R&D costs, patents, prototypes.

- Example: A biotech firm spent $800K on R&D and $200K on patents—total $1 million valuation.

- Adjust for intangibles like brand, but keep conservative.

Pros: Objective. Cons: Ignores future earnings. Great for asset-heavy ventures.

4. Comparable Transactions Method: Market-Based Insights

Look at recent sales or funding of similar startups.

Steps to Apply:

- Research deals via PitchBook or AngelList (e.g., a fintech acquired at 5x revenue).

- Apply multiples: For SaaS, use 4-7x annual recurring revenue (ARR).

- Example: If a competitor sold for $20 million at $4 million ARR (5x multiple), your $1 million ARR startup might value at $5 million.

This reflects real venture capital valuation trends in 2025.

5. Risk Factor Summation Method: Adjust for Uncertainties

Start with a base from another method, then tweak for risks.

Steps to Apply:

- List 12 risks: Management, funding, competition, etc.

- Add/subtract $250K-$500K per low/high risk.

- Example: Base $2 million; low competition (+$250K), high funding risk (-$500K) = $1.75 million.

Helps in risk factor analysis for volatile markets.

6. Discounted Cash Flow (DCF) for Startups: Future-Focused

Project cash flows and discount back to present value.

Steps to Apply:

- Forecast revenues (e.g., $0 now, $5 million in year 5).

- Use high discount rate (30-50% for risk).

- Formula: Present Value = Future Cash Flow / (1 + Discount Rate)^Years.

- Example: $10 million in year 5 at 40% discount = about $3.5 million today.

Best for startups with some traction; combine with discounted cash flow (DCF) for startups.

7. Venture Capital Method: Investor Perspective

Back-calculate from expected exit.

Steps to Apply:

- Estimate terminal value (e.g., $50 million exit in 5 years).

- Divide by ROI goal (e.g., 10x for VCs).

- Post-money = Terminal / ROI; Pre-money = Post-money – Investment.

- Example: $50M exit / 10x = $5M post-money for $1M raise = $4M pre-money valuation.

Aligns with angel investor valuation.

8. Book Value Method: Basic Balance Sheet

Assets minus liabilities.

Steps to Apply:

- From your balance sheet: $500K assets – $200K debts = $300K.

- Example: Early hardware startup with equipment worth $1 million nets $800K after loans.

Simple but limited for intangibles.

Tools and Resources for Startup Valuation

Leverage free tools like CalcXML or Swipesum calculators. For data, check Crunchbase for startup worth calculation.

In 2025, factors like AI integration can spike values—Nvidia’s market influence shows tech trends matter2.

For startup financial modeling, use Excel templates from HubSpot. Also, manage your cap table management early to avoid dilution pitfalls.

While valuing, stay safe online—protect your phone number online during investor outreach. Avoid scams; learn about spotting and reporting phone scams.

Common Pitfalls and Tips for Accurate Valuation

Avoid overhyping projections—investors spot it. Instead:

- Use multiple methods for triangulation.

- Stress-test with scenarios (best/worst case).

- Get advisor input for founder equity split.

- Consider location: US startups average higher multiples.

Tip: For no-revenue cases, focus on market opportunity assessment.

Example: A 2025 healthtech startup with no sales but a patented app valued at $3 million via Scorecard, citing strong team and $100B TAM.

Preparing for Funding: Valuation in Action

When pitching, justify your number. Show revenue projection slides. Investors seek post-money valuation clarity.

For startup funding valuation, aim for 10-20% dilution in seed rounds.

If you’re an investor, use these to assess startup equity valuation.

Case Studies: Real-World Examples

- Airbnb: Early valuation via comparables hit $1.3 million pre-money in 2009, exploding later.

- Uber: DCF helped forecast growth, leading to unicorn status.

In Tier 2 markets like India, adjust for local risks—see how to do valuation of a startup in pakistan for similar insights.

Advanced Considerations in 2025

With rising interest rates, discount rates are up 5-10%. Factor in factors affecting startup valuation in 2025 like sustainability.

For Series A/B/C valuation, shift to earnings multiples.

Use AI tools for projections, but verify manually.

FAQs on Startup Valuation

How to calculate pre-money valuation for early-stage startups?

Subtract investment from post-money.

What investors look for in startup valuation?

Traction, team, and scalable model.

Methods to determine startup worth before funding?

Try Berkus or Scorecard.

Startup valuation formula for seed funding?

Often pre-money = Assets + Potential – Risks.

Conclusion: Mastering How to Do Valuation of a Startup

In summary, how to do valuation of a startup involves blending methods like Berkus for pre-revenue or DCF for growth stages. Focus on your strengths, back with data, and iterate3. This ensures fair deals and growth potential. What’s your biggest challenge in valuing your startup—share in the comments to spark discussion!

References

- 10 Methods To Calculate Your Startup’s Valuation – Practical steps and tools for fundraising prep. ↩︎

- Valuing Startup Ventures – Expert breakdown of financial techniques with pros/cons. ↩︎

- How to do a startup valuation: 8 different methods – Comprehensive guide on methods for early-stage founders. ↩︎