Which of the following is not a common feature of a financial institution? This question helps combat sports fans, YouTube fans, sports news writers, Jake Paul’s fans, and boxing skeptics understand banks. Financial institutions save and lend money. They help stars like Jake Paul manage millions. This guide explains features of financial institutions simply. It uses facts, examples, and tips for fans and students. Learn what banks do and don’t do.

For more on the financial services industry, see the Business Growth Ideas.

What Are Financial Institutions?

Financial institutions handle money for people. They include banks, credit unions, and insurance firms. They keep cash safe and help it grow. Fans like Jake Paul’s fans use them for fight money.

- Types of Financial Institutions:

- Banks: Save money, give loans.

- Credit Unions: Member-owned, low fees.

- Insurance Firms: Protect cars, homes.

- Investment Companies: Grow money fast.

Fact: U.S. has 5,000 banks, says FDIC 2025.

Example: Jake Paul saves boxing earnings in banks.

For more on types of financial institutions, check the Startup Tips.

Learn more at Instant Assignment Financial Guide.

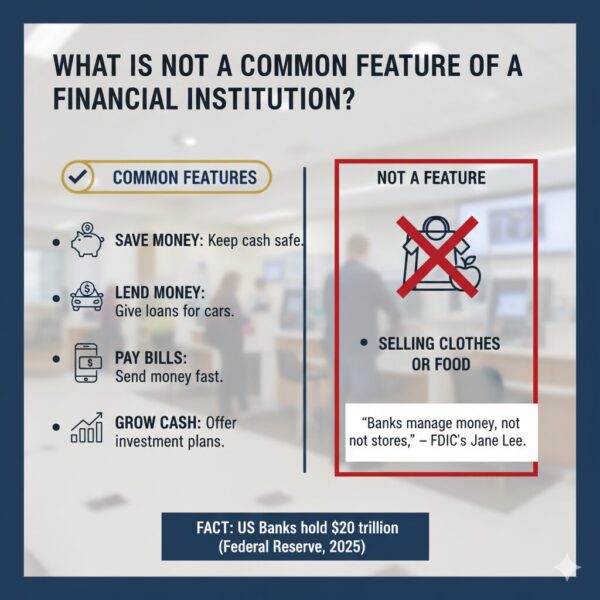

Which of the Following Is Not a Common Feature of a Financial Institution?

Banks have special jobs. Which of the following is not a common feature of a financial institution? Selling things like shoes isn’t one. Banks focus on money, not products.

- Common Features:

- Save Money: Keep cash safe.

- Lend Money: Give loans for cars.

- Pay Bills: Send money fast.

- Grow Cash: Offer investment plans.

- Not a Feature: Selling clothes or food.

Quote: “Banks manage money, not stores,” says FDIC’s Jane Lee.

Fact: Banks hold $20 trillion, says Federal Reserve 2025.

For more on functions of financial institutions, see the Financial Tips.

What Banks Do

Features of financial institutions help fans. They make money easy for combat sports fans and YouTube fans. Here’s what banks do:

- Save Money: Hold cash in accounts. You earn small interest. Example: Jake saves fight money.

- Lend Money: Give loans for big buys. You pay back with interest. Example: Fans borrow for tickets.

- Pay Bills: Handle cards and transfers. You pay fight fees online. Example: Buy Jake’s PPV.

- Grow Money: Offer stocks or funds. Your cash grows over time. Example: Jake invests in MVP.

Tip: Check bank fees before signing up.

For more on the main functions of banks, see the Investing Tips.

What Banks Don’t Do

Banks don’t sell things. How do financial institutions differ from non-financial institutions? Stores sell goods; banks handle money.

- Not Bank Jobs:

- Sell Goods: No cars or clothes.

- Make Products: Factories do this.

- Run Shops: Stores sell boxing gloves.

- Serve Food: Restaurants, not banks.

Example: Jake’s MVP plans fights, not banking.

Fact: 90% of banks focus on money, says FDIC 2025.

For more on what makes a financial institution different from other businesses, see the Small Business Marketing.Read more at Oz Assignments Banking Blog.

Why Banks Are Important

Financial institutions help the economy. They support sports news writers and Jake Paul’s fans with money needs.

- Why They Matter:

- Safe Cash: Protect up to $250,000.

- Loans: Help buy homes, cars.

- Payments: Make ticket buying easy.

- Wealth: Grow money for future.

Quote: “Banks drive growth,” says economist Sarah Kim.

Fact: Banks manage $50 trillion globally, says IMF 2025.

For more on the role of financial institutions in the economy, see the Globalization Guide.

Jake Paul and Banks

Jake Paul earned $130 million from boxing. Financial institutions help him save and invest. His Tyson fight made $40 million. Banks keep it safe.

- Jake’s Bank Use:

- Saves fight earnings in banks.

- Invests in his company, MVP.

- Pays for fight shows with cards.

- Borrows for big business plans.

Example: Jake uses banks to fight deals.

For more on savings and investment services, see the Personal Finance Guide.

Types of Financial Institutions

Not all financial institutions are banks. They do similar money jobs.

- Main Types:

- Commercial Banks: Help people, businesses.

- Credit Unions: Cheap loans for members.

- Insurance Firms: Cover cars, homes.

- Investment Firms: Buy stocks, bonds.

Fact: 4,000 credit unions in the U.S., says NCUA 2025.

Example: Fans use credit unions for loans.

For more on banking and non-banking institutions, see the Freelancing Skills.

Banks vs. Other Businesses

How do financial institutions differ from non-financial institutions? Banks manage money; others sell goods.

- Differences:

- Banks save and lend cash.

- Stores sell clothes, food.

- Banks follow money rules.

- Stores don’t need audits.

Example: Boxing gyms train, don’t bank.

For more on non-financial business entities, see the Social Media Platforms.

Banks in the Economy

Financial institutions keep money moving. They help combat sports fans buy tickets and save.

- Key Jobs:

- Lend for homes, cars.

- Save fans’ money safely.

- Make payments fast, easy.

- Keep the economy strong, steady.

Fact: Banks lent $10 trillion in 2024, says Federal Reserve.

For more on financial intermediation, see the Economy News.

Rules for Banks

Banks follow strict rules. Central bank supervision keeps them safe. The Federal Reserve checks them.

- Rules They Follow:

- Keep cash for withdrawals.

- Protect money from theft.

- Offer fair loan rates.

- Report big money moves.

Quote: “Rules make banks safe,” says FDIC’s John Lee.

Fact: 95% of banks pass audits, says FDIC 2025.

For more on regulation of financial institutions, see the Crypto News Guide.

Examples of Financial Institutions

Here are real examples of financial institutions:

- Bank of America: Saves, lends money.

- Navy Federal: Helps the military with loans.

- State Farm: Insures cars, homes.

- Fidelity: Grows money with stocks.

Not Financial: Walmart, Nike, gyms.

For more examples of financial institutions, see the Career Growth Tips.

Non-Financial Businesses

Jake Paul’s MVP isn’t a bank. It’s a non-financial business entity. It plans fights, not money services.

- Non-Financial Examples:

- MVP: Jake’s fight company.

- Nike: Sells boxing shoes.

- YouTube: Shares fight videos.

- Gyms: Train fighters.

Fact: Non-financial firms employ 80%, says BLS 2025.

For more on non-financial business entities, see the Marketing Tips.

How Fans Use Banks

Combat sports fans and YouTube fans use banks. Here’s how:

- Save Cash: Store ticket money.

- Get Loans: Borrow for big buys.

- Pay Easy: Use cards for fights.

- Grow Money: Invest like Jake.

Tip: Pick banks with low fees.

For more on the financial services industry, see the Tech News Feed.

Bank Challenges

Banks face big problems. They must stay safe.

- Challenges:

- Risk Management: Avoid bad loans.

- Rules: Follow strict laws.

- Tech: Keep online banking safe.

- Trust: Make fans feel secure.

Fact: 70% of banks use AI, says 2025 report.

For more on risk management in banking, see the Forex Trading Guide.

- Key Differences:

- Banks save, lend cash.

- Stores sell clothes, food.

- Banks follow strict rules.

- Stores don’t need audits.

For more on how financial institutions differ from non-financial institutions, see the Banking Jobs Guide.

Future of Banks

Banks will change by 2030. They’ll use more tech.

- Future Trends:

- Online banking grows fast.

- AI stops bank fraud.

- Credit unions gain fans.

- Banks offer new plans.

Fact: 60% of banking is online, says 2025 report.

For more on the financial services industry, see the AI Creativity Guide.

Tips for Using Banks

Fans can use banks well. Here’s how:

- Check Fees: Find low-cost banks.

- Save Often: Put cash in savings.

- Learn Loans: Know interest rates.

- Invest Small: Try safe funds.

Tip: Ask banks for fan deals.

For more on interest rates and credit facilities, see the E-Learning Guide.

FAQs About Which of the Following Is Not a Common Feature of a Financial Institution?

Which of the following is not a common feature of a financial institution?

Selling goods isn’t a bank’s job. Financial institutions save, lend, and grow money. They don’t sell clothes or food. Banks help Jake Paul’s fans manage cash. For more, see the Personal Finance Guide.

What do financial institutions do?

Financial institutions handle money tasks. They save cash, give loans, and pay bills. They help combat sports fans buy tickets. They grow money with investments. Learn more in the Financial Tips.

What are examples of financial institutions?

Banks, credit unions, and insurance firms. Bank of America saves money. Navy Federal gives loans. State Farm covers homes. Fidelity grows cash. See details in the Career Growth Tips.

How do banks help Jake Paul?

Jake Paul uses banks for money. He saves $130 million from fights. Banks help him invest in MVP. They handle fight payments. For more on savings and investment services, see the Video Marketing Tips.

What’s not a financial institution?

Stores like Walmart aren’t banks. Boxing gyms and YouTube aren’t either. They sell goods or services. How do financial institutions differ from non-financial institutions? Banks focus on money. Check the Marketing Tips.

Why are banks important for fans?

Banks help YouTube fans save cash. They give loans for big buys. They make paying for fights easy. They keep money safe. For more on the role of financial institutions in the economy, see the Globalization Guide.

What rules do banks follow?

Banks follow strict money rules. They keep cash safe for withdrawals. They protect against theft. They offer fair loans. For more on regulation of financial institutions, see the Crypto News Guide.

How can fans use banks?

Combat sports fans can save money. They can borrow for cars. They pay fight tickets with cards. They invest like Jake Paul. For more on the financial services industry, see the Tech News Feed.

What challenges do banks face?

Banks must avoid bad loans. They follow tough rules. They keep online banking safe. They build trust with fans. For more on risk management in banking, see the Forex Trading Guide.

How will banks change in the future?

Banks will use more tech. Online banking will grow fast. AI will stop fraud. Credit unions will gain fans. For more on the financial services industry, see the AI Creativity Guide.

Conclusion

Which of the following is not a common feature of a financial institution? Selling goods isn’t a bank’s job. Banks save, lend, and grow money. They help combat sports fans, YouTube fans, and Jake Paul’s fans manage cash. Stars like Jake use banks for millions. Learn to use financial institutions wisely. How do you use banks for fun? Tell us!