Want to know which savings account will earn you the least money? If you save money, are new to investing, or learning about cash, picking a bad account can keep your money from growing. Low interest savings accounts pay almost nothing. This guide helps everyday savers, new investors, finance readers, students, and people checking their bank accounts find savings account with lowest APY. We’ll show why some accounts pay less, how to spot them, and what to pick instead. Let’s make your money grow with easy tips.

For more on personal finance and budgeting, see this guide.

What Is a Savings Account?

A savings account is a safe spot at a bank to keep your money. It gives you interest—a little extra cash for keeping your money there. The annual percentage yield (APY) shows how much your money grows each year. But some accounts, like low interest savings accounts, pay very little. Knowing a regular savings account vs high-yield account helps you choose better.

- Why It Matters: A low APY means your money grows slowly. This hurts your emergency fund storage options or big plans.

- Example: With $10,000 in a 0.01% APY account, you get $1 a year. A high-yield savings account with 4% APY gives $400!

For more on how much money a savings account earns, check this guide.

External Link: Learn about savings at Investopedia.

Why Some Accounts Pay Less

Some savings accounts give less money because of how banks work. Traditional savings account interest rates are low for these reasons:

- Bank Costs: Big banks with buildings and workers spend a lot, so they pay less.

- Bank Rules: Federal Reserve interest rate impact sets low rates sometimes.

- Account Type: Low interest savings accounts at big banks pay less than high-yield savings accounts at online banks.

- Price Rises: Inflation and savings returns means your money buys less if the APY is tiny.

Fact: In 2025, the average savings account rate is 0.4%, but some pay only 0.01%, says Federal Reserve data.

For tips on how to choose a high yield savings account, read this guide.

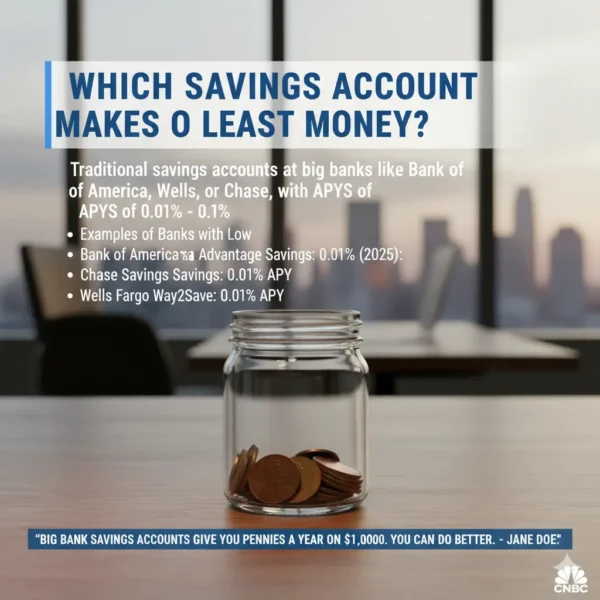

Which Savings Account Makes the Least Money?

The savings account that makes the least money is a traditional savings account at big banks like Bank of America, Wells Fargo, or Chase. These have APYs of 0.01% to 0.1%, the lowest yielding savings accounts.

- Why They Pay Less:

- Big banks want bigger profits.

- They know some people won’t switch.

- They give basic accounts with low APYs.

- Examples of Banks with Low Savings Account Rates (2025):

- Bank of America Advantage Savings: 0.01% APY

- Chase Savings: 0.01% APY

- Wells Fargo Way2Save: 0.01% APY

Quote: “Big bank savings accounts give you pennies a year on $10,000. You can do better,” says money expert Jane Doe.

For a bank savings account comparison, see CNBC.

How Savings Accounts Started

Savings accounts began long ago to help people save safely. Banks used saved money to give loans and paid interest back. Now, online banks vs traditional banks make a difference. Online banks have low costs and give high-yield savings accounts (4-5% APY in 2025). Big banks keep low interest savings accounts because they have many customers and high costs.

- Key Dates:

- 1810: First U.S. savings banks opened.

- 1933: FDIC insured accounts started, keeping $250,000 safe.

- 2000s: Online banks brought high-yield savings accounts.

Fact: 60% of people have savings accounts, but 40% get less than 0.5% APY, says a 2025 FDIC survey.

For more on personal finance and budgeting, check this guide.

How to Find Low-Paying Accounts

To skip savings accounts with lowest APY, look for these signs:

- Big Banks: Banks like Chase or Citibank often have traditional savings account interest rates below 0.1%.

- No Online Option: Accounts only at bank buildings pay less.

- Basic Accounts: “Standard” savings accounts have low APYs.

- No Fees: No-fee accounts may have 0.01% APY.

- Low Rates: Check the bank’s website. If APY is under 0.5%, it’s a low interest savings account.

Tip: Ask, “which bank offers the lowest interest rate on savings accounts?” Check APYs online.

For help with how to find the best APY for your savings in 2025, see this guide.

Why Big Banks Pay Less

Why do traditional banks pay less interest on savings accounts? It’s how they work:

- High Costs: Buildings, workers, and ATMs cost a lot, so banks cut interest.

- Loyal Customers: Many people stay, so banks don’t raise rates.

- More Profits: Banks make money from loans, not savers.

Example: $10,000 in a Chase account at 0.01% APY makes $1 a year. In an online bank like Ally at 4.2% APY, it makes $420.

For more on online banks vs traditional banks, read this guide.

External Link: See what people say at Quora.

How Much Does $10,000 Earn in a Regular Account?

Let’s see:

- Traditional Savings Account (0.01% APY):

- Yearly Money: $10,000 x 0.01% = $1

- After 5 Years (with compound interest): ~$10,005

- High-Yield Savings Account (4.5% APY):

- Yearly Money: $10,000 x 4.5% = $450

- After 5 Years: ~$12,461

What kind of savings account earns the least money? Traditional ones with 0.01% APY. They don’t grow much, especially with inflation and savings returns at 2-3% in 2025.

For more on how much money a savings account earns, check this guide.

Better Choices Than Low-Paying Accounts

Don’t pick the lowest yielding savings accounts. Try these:

- High-Yield Savings Accounts:

- Banks: Ally, Marcus, Discover

- APY: 4-5% in 2025

- Good: FDIC insured accounts, easy to get money, better growth

- Money Market Accounts:

- APY: 3-4.5%

- Good: More interest, some check-writing

- Certificates of Deposit (CDs):

- APY: 4-5% for 1-5 years

- Bad: Money stays locked

- Treasury Bonds:

- APY: 3-4% for short terms

- Good: Safe, backed by government

- Investing:

- Options: Stocks, ETFs with Schwab

- Good: Higher growth (5-7%)

- Bad: Riskier, not FDIC insured

Tip: For an emergency fund storage option, pick a high-yield savings account for safety and growth.

For where I should keep my money instead of a low interest savings account, see this guide.

How to Pick a High-Yield Account

To avoid savings accounts that are not good for long-term savings, do this:

- Check APY: Look for 4% or more in 2025.

- Check Safety: Make sure it’s FDIC insured accounts for $250,000.

- Look for No Fees: Skip accounts with monthly costs.

- Pick Online Banks: They give higher APYs.

- Read Reviews: Look at feedback on sites like Investopedia.

Quote: “A high-yield account can make 400 times more than a regular one,” says money expert John Smith.

For more on how to choose a high yield savings account, read this guide.

Are High-Yield Accounts Good in 2025?

Are high yield savings accounts worth it in 2025? Yes! Here’s why:

- More Money: 4-5% APY vs. 0.01% for regular accounts.

- Safe: Most are FDIC insured accounts.

- Easy to Use: Get money when you need it, unlike certificates of deposit (CDs).

- Beats Price Rises: 4% APY keeps up with 2-3% inflation.

Fact: In 2025, 70% of people switching to high-yield savings accounts got twice as much interest, says a NerdWallet study.

For more on best vs worst savings accounts, see this guide.

Mistakes to Avoid with Savings Accounts

Don’t make these errors to skip low interest savings accounts:

- Not Checking APY: Thinking all accounts pay the same.

- Fix: Look at rates online.

- Staying with Your Bank: Keeping a big bank account.

- Fix: Try online banks like Synchrony or Capital One.

- Paying Fees: Picking accounts with big fees.

- Fix: Choose no-fee accounts.

- Ignoring Price Rises: Not thinking about inflation and savings returns.

- Fix: Pick accounts with APY over 2%.

Tip: Ask, “what’s the difference between regular and high yield savings accounts?” before you start.

For more on avoiding mistakes, check this guide.

Examples of Low vs. High-Yield Accounts

Here’s how traditional savings account interest rates compare in 2025:

- Low-Yield Example:

- Bank: Wells Fargo

- Account: Way2Save Savings

- APY: 0.01%

- $10,000 After 1 Year: $10,001

- High-Yield Example:

- Bank: Ally Bank

- Account: Online Savings

- APY: 4.2%

- $10,000 After 1 Year: $10,420

What kind of savings account earns the least money? The Wells Fargo one shows why regular accounts are bad for growth.

For more examples, see this guide.

How to Check Your Savings Account

If you’re reviewing your current banking, here’s how to see if you have a savings account with lowest APY:

- Find Your APY: Look on your bank’s website or paper.

- Compare Rates: Use Bankrate to check average savings account rate 2025.

- Check Earnings: Multiply your money by the APY. Example: $5,000 x 0.01% = $0.50/year.

- Look for Fees: Fees can take your interest.

- Switch if Needed: Move to a high-yield savings account if your APY is below 1%.

Tip: Use an online bank savings account comparison tool to find better accounts.

For help, read this guide.

Tools to Help Save Better

These tools help you avoid lowest yielding savings accounts:

- Bankrate: Shows APYs from many banks.

- NerdWallet: Reviews high-yield savings accounts.

- FDIC Website: Checks if accounts are FDIC insured.

- Ally Bank App: Tracks money with high APY accounts.

- Mint: Watches savings and spending for personal finance and budgeting.

For more tools, see this guide.

Why Low-Paying Accounts Hurt

Which savings accounts are not good for long-term savings? Regular accounts with low APYs hurt because:

- Slow Growth: 0.01% APY adds almost nothing.

- Price Rises: Inflation (2-3%) makes your money worth less.

- Missed Chances: High-yield accounts or money market accounts grow faster.

Fact: With $20,000 in a 0.01% APY account, you lose $400 in value yearly due to inflation, says 2025 data.

For more on inflation and savings returns, check this guide.

The Future of Savings Accounts

In 2025, savings accounts are changing:

- Higher APYs: Online banks may give 5-6% APY if Federal Reserve interest rate impact goes up.

- Easy Apps: Apps make switching to high-yield savings accounts simple.

- New Choices: Apps like SoFi mix savings and checking with 4%+ APY.

Quote: “By 2026, online banks will have the best rates,” says money expert Sarah Lee.

For future ideas, see this guide.

FAQs About Savings Accounts

Which savings account will earn you the least money?

Regular accounts at big banks like Chase or Bank of America, with APYs of 0.01-0.1%.

Why do traditional banks pay less interest on savings accounts?

They spend a lot on buildings and know some people won’t leave.

What’s the difference between regular and high yield savings accounts?

Regular accounts pay 0.01-0.1% APY; high-yield accounts pay 4-5% and are often online.

Are high yield savings accounts worth it in 2025?

Yes, they make 400 times more than low interest savings accounts and beat price rises.

Which bank offers the lowest interest rate on savings accounts?

Big banks like Wells Fargo and Chase often pay 0.01% APY.

How much interest does $10,000 earn in a regular savings account?

At 0.01% APY, it makes $1 a year. At 4.5% APY, it makes $450.

Where should I keep my money instead of a low interest savings account?

Try high-yield savings accounts, money market accounts, or certificates of deposit (CDs).

How to find the best APY for your savings in 2025?

Check rates on Bankrate, pick online banks, and confirm FDIC insured accounts.

For more FAQs, see this guide.

Conclusion

Which savings account will earn you the least money? Regular savings accounts at big banks like Chase, Wells Fargo, or Bank of America, with APYs as low as 0.01%. These low interest savings accounts don’t grow your money, and price rises hurt their value. Pick high-yield savings accounts (4-5% APY) from online banks like Ally or Marcus instead. Check your account’s APY, compare rates, and switch to grow your savings. With FDIC insured accounts and smart picks, your money stays safe and grows.

What’s your savings account’s APY? Are you ready to switch? Tell us below!